Understanding the Pocket Option Volume Indicator

The Pocket Option Volume Indicator is one of the essential tools for traders looking to optimize their trading strategies. By analyzing volume, traders can gain insights into market trends and the strength of price movements. Whether you’re a novice or an experienced trader, understanding how to use this indicator can significantly enhance your trading outcomes. For those looking to practice and gain insights without the risk, you can check out the pocket option volume indicator https://pocketoption-1.com/demo-account/ offered by Pocket Option.

What is the Volume Indicator?

The Volume Indicator is a graphical representation of the number of shares or contracts traded in a security or commodity over a given period. In the context of trading platforms like Pocket Option, this indicator allows traders to determine how actively a stock or asset is being traded. Typically displayed as a histogram, the bars represent the total volume of trades during a specific timeframe. A higher volume indicates heavier trading activity, potentially signifying stronger market interest.

Why is Volume Important in Trading?

Volume plays a crucial role in validating price movements. For instance, a price change accompanied by higher volume may suggest that the move is supported by a significant market interest, presenting a stronger case for that price action continuing. Conversely, if a price movement occurs with low volume, it may indicate a lack of support, suggesting that the movement could be less reliable.

How to Use the Pocket Option Volume Indicator?

1. Confirming Breakouts

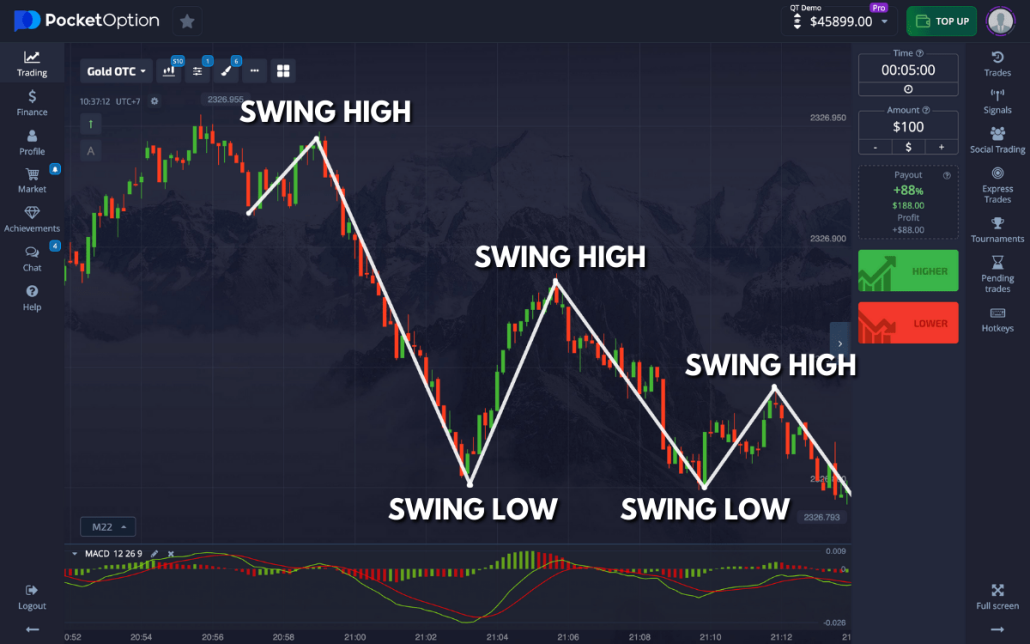

One of the primary uses of the volume indicator is to confirm breakouts. When price breaks through a significant resistance or support level, traders will look for a corresponding increase in volume. If the price breaks above resistance with high volume, it signals that buyers are present, likely resulting in a continuation of the trend.

2. Identifying Reversals

Volume can also be a critical factor in identifying potential reversals. If a particular asset’s price reaches a critical level, but volume decreases, this may indicate weakening momentum. Traders often use this information to predict that the current trend may not hold, signaling a possibility for a reversal.

3. Creating Divergence Signals

Traders also look for divergences between price and volume to make informed decisions. If prices are moving higher while volume is declining, this divergence can indicate that the price may need to adjust, potentially leading to a pullback or reversal. Recognizing these patterns can give traders an edge in timing entries and exits.

Setting Up the Pocket Option Volume Indicator

Getting started with the Volume Indicator on Pocket Option is straightforward. Here are the steps to set it up:

- Log into your Pocket Option account.

- Select the asset you wish to trade.

- Open the chart for your selected asset.

- Locate the indicator option in the toolbar.

- Select the Volume Indicator from the list.

- Adjust the settings if necessary (some traders prefer to tweak the period over which volume is calculated).

Once set up, the Volume Indicator will begin to display on your chart, providing you with critical insights into market dynamics.

Combining Volume with Other Indicators

While the Volume Indicator is powerful on its own, combining it with other technical indicators can enhance its efficacy. For example, pairing the volume with Moving Averages or Relative Strength Index (RSI) can provide a more comprehensive view of market conditions. This multi-faceted approach allows traders to filter out false signals and make more informed trading decisions.

Common Mistakes to Avoid

Traders often make some common mistakes when using the Volume Indicator. Here are a few to be mindful of:

- Ignoring Context: Volume should always be interpreted in context. High volume in a downtrend might not be bullish unless confirmed by other indicators.

- Overreacting to Volume Spikes: While volume spikes can signal important events, they should be analyzed carefully. A sudden spike doesn’t always indicate a trend change, especially without supporting price action.

- Neglecting to Use Stop Losses: Even with a good volume strategy, market conditions can change rapidly. Always employ risk management strategies like stop losses to protect your capital.

Conclusion

The Pocket Option Volume Indicator is a critical tool that can enhance a trader’s ability to analyze market dynamics effectively. By understanding how to interpret volume changes alongside price movements, traders can make more informed decisions. As with any trading strategy, practice and continuous learning through accounts like the demo account provided by Pocket Option will help improve your skills. Always remember that managing risk and being disciplined in your trades are equally essential components of a successful trading strategy.