Helpful Fool Company’s board has elected to issue just 2,000 shares at this time. Therefore, the company currently has authorized 5,000 shares and has 2,000 shares issued and outstanding. The shareholders equity ratio measures the proportion of a company’s total equity to its total assets on its balance sheet.

Is there any other context you can provide?

For example, if you sell high-demand products with demand variability, the signal stock will be the amount of that product you will have on hand (let’s say 500 pieces) to signal when to reorder. So when the inventory of that product becomes 500 pieces, it will give you a signal to start ordering or producing more of that product. This means the company has distributed USD 10 million in dividends during product and period costs the year. If you’re going to become an investor, there are a few things you should know — like these formulas. A company with a relative cost advantage is likely to be more profitable, and companies in industries with high switching costs can more easily retain customers. High-quality companies often have intangible assets, e.g., patents, regulations, and brand recognition, with considerable value.

How to Calculate Safety Stock?

- If you need to calculate the growth rate, tap/click the link on this line to open the stock growth rate calculator in a new window.

- This free online Stock Price Calculator will calculate the most you could pay for a stock and still earn your required rate of return.

- By exploring these examples, one can better understand the nuances of common stock calculations in different scenarios.

- Dividends declared represent the total amount a company has committed to paying its shareholders after a formal announcement.

- If you’re going to become an investor, there are a few things you should know — like these formulas.

Let’s see some simple to advanced examples of issuance of common stock calculation to understand it better. Thus, from the above details, we can understand the various valuation of common stock. This calculation ensures that you have enough buffer stock to meet average demand. Our above calculation says that the results with this formula are something that will definitely bring stock out. However, we need cumulative probabilities if we want to predict the likelihood of stock-out, which is the main purpose of keeping safety stocks. So, now, we can easily calculate the probability that the order will be received in 7, 8, 9, 10, or 11 days.

Dividend payout ratio

While both types confer ownership in a company, preferred stockholders have a higher claim to the company’s assets and dividends than common stockholders. Traded on exchanges, common stock can be bought and sold by investors or traders, and common stockholders are entitled to dividends when the company’s board of directors declares them. 1.Common Stocks– An investor can purchase both types of stocks when available as both have their own privileges. When people purchase common stocks, it means they have voting right in the important decisions and other events in the company.

Common Stock Vs Preferred Stock

This post will cover some tips and calculations for determining the right amount of safety stock and formulas and methods to minimize inventory costs and avoid stockouts. This means the company still owes shareholders USD 500,000 in dividends, which will be listed under current liabilities. This formula shows the percentage of the company’s earnings paid out in dividends.

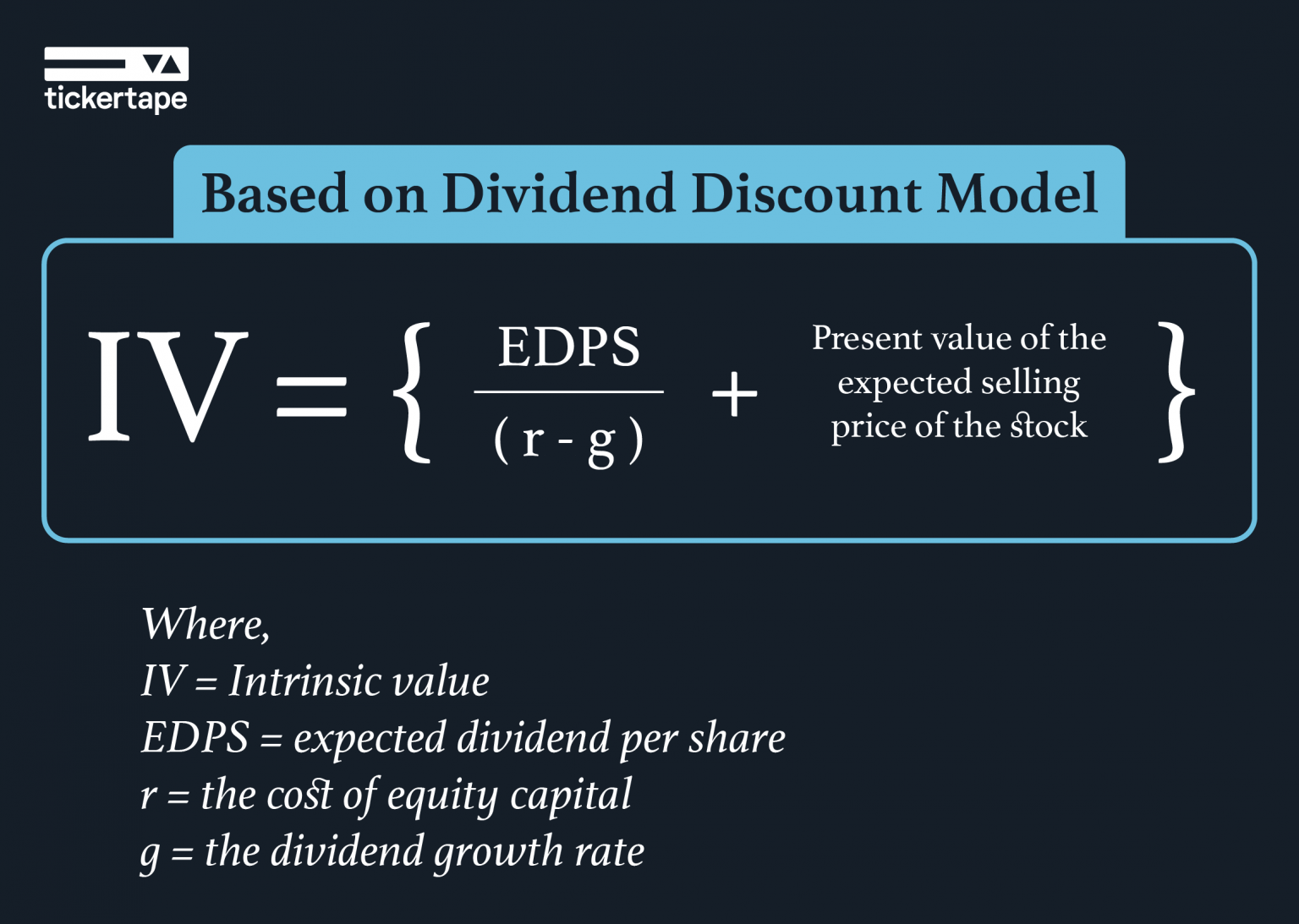

This is more common in some sectors of the stock market — such as the energy sector — but less common in others, such as the technology sector. Typically, energy companies such as oil stocks like to return profits to shareholders, while technology stocks prefer to reinvest them in their own growth. If a share of stock has been issued and has not been reacquired by the corporation, it is said to be outstanding. Now that we have an understanding of what shareholders’ Equity is, we can now show the entry of common stock in a balance sheet in the stockholders’ section of a financial statement. The dividend growth model for common stock valuation assumes that dividends will be paid, and also assumes that dividends will grow at a constant pace for an indefinite period.

A high yield can sometimes result from a declining stock price, which could signal underlying financial issues. In contrast, a lower yield from a stable or growing company might indicate a safer, more sustainable dividend. A lower payout ratio often indicates that the company prioritises growth, while a higher ratio might suggest a focus on returning profits to shareholders.

Issuing common stock is recorded as a credit to the common stock account and a corresponding debit to the cash or other asset account received in exchange for the shares. This reflects an increase in the company’s equity and cash or other asset balances. It represents the assets, liabilities, and stockholder’s equity at a particular point in time. It records the company’s income and expenditure and compares it with the previous year’s data, and results out the company’s net profit and loss. Here we will discuss how to calculate common stocks, and preferred stocks also play a role in calculating common stocks.