Understanding Forex Trading: A Beginner’s Guide to Currency Markets

Forex trading, short for foreign exchange trading, is the act of buying and selling currencies on the global market. This decentralized market is the largest and most liquid financial market in the world, where trillions of dollars are traded daily. With the rise of technology, forex trading has become accessible to a wider range of individuals, allowing more people to participate in this lucrative market. If you’re keen on diving into currency trading, this guide will provide you with essential insights and tips to get started. For those in Kuwait, we recommend checking out currency trading forex Forex Brokers in Kuwait that can help you kickstart your trading journey.

What is Forex Trading?

At its core, forex trading involves exchanging one currency for another with the aim of profiting from changes in exchange rates. Currencies are traded in pairs—such as EUR/USD or GBP/JPY—where the value of one currency is compared against another. The forex market operates 24 hours a day, five days a week, allowing traders to execute trades at virtually any time from anywhere in the world.

The Structure of the Forex Market

The forex market is decentralized, meaning there is no central exchange where trading takes place. Instead, transactions occur over-the-counter (OTC) through electronic networks among banks, financial institutions, brokers, and individual traders. This structure allows for greater flexibility and liquidity, but it also means traders must be diligent in choosing trustworthy forex brokers.

Types of Participants in the Forex Market

Various stakeholders make up the forex trading landscape, including:

- Central Banks: They manage a country’s currency and monetary policy, influencing exchange rates through interest rates and market interventions.

- Commercial Banks: Major banks facilitate currency trading for clients and speculate on currency movements.

- Hedge Funds and Investment Firms: These entities speculate on currency movements to generate profits and manage risks.

- Retail Traders: Individuals trading currency pairs from their home computers, seeking to profit from market fluctuations.

Fundamental vs. Technical Analysis

Successful forex traders often rely on two main types of analysis to make their trading decisions: fundamental and technical analysis.

Fundamental Analysis

This approach involves analyzing economic indicators and news events that impact currency values. Factors such as interest rates, inflation, employment data, and geopolitical developments play a significant role in influencing currency prices. By staying updated on these metrics, traders can make informed decisions about potential currency movements.

Technical Analysis

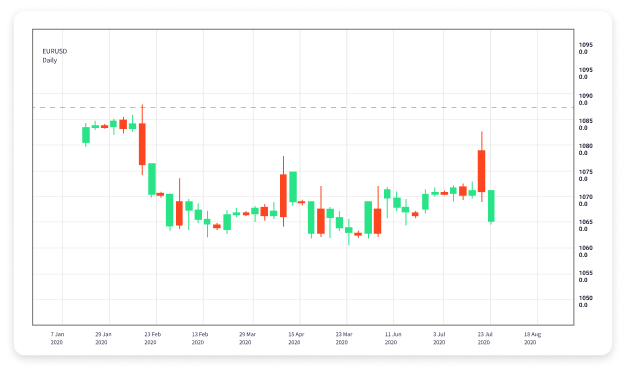

Technical analysis focuses on price charts and historical data to identify trends and patterns. Traders use various indicators (such as moving averages, RSI, and MACD) and chart patterns (like head and shoulders, flags, and triangles) to predict future price movements. This method assumes that past price movements can provide insights into future price behavior.

Key Trading Strategies

There are numerous strategies that traders employ in the forex market, depending on their trading goals and risk tolerance. Here are a few popular ones:

- Day Trading: Involves opening and closing trades within the same day. Day traders seek to profit from short-term price movements and avoid overnight risks.

- Swing Trading: This strategy focuses on capturing short- to medium-term price movements by holding trades from a few days to several weeks.

- Scalping: Scalpers aim to make small profits on numerous trades throughout the day, often holding positions for seconds or minutes.

- Position Trading: A long-term strategy where traders hold positions for weeks, months, or even years based on fundamental analysis.

Choosing the Right Forex Broker

Selecting a broker is a crucial step in your forex trading journey. Here are key factors to consider:

- Regulation: Ensure your broker is regulated by a reputable authority to protect your funds and ensure fair trading practices.

- Trading Platform: A user-friendly and robust trading platform with access to essential tools is vital for successful trading.

- Spreads and Commissions: Compare different brokers’ fees to ensure you’re getting a reasonable deal.

- Customer Support: Reliable and accessible customer service is important for resolving issues that may arise.

Risk Management in Forex Trading

Managing risk is essential when trading forex to protect your capital and minimize potential losses. Here are some key risk management strategies:

- Use Stop-Loss Orders: Setting stop-loss orders helps limit your losses by automatically closing a trade when it reaches a specified price level.

- Diversify Your Portfolio: Avoid putting all your capital into one trade. Spread your capital across multiple currency pairs or different asset classes.

- Only Risk a Small Percentage: Many traders recommend risking only 1-2% of your trading capital on a single trade to protect your account from significant losses.

The Importance of Continued Education

The forex market is constantly evolving, and successful traders stay informed about changes in market dynamics, new trading strategies, and economic indicators. Engaging in continued education through webinars, courses, and reading resources can enhance your trading skills and increase your chances of success in forex trading.

Conclusion

Forex trading offers exciting opportunities for those willing to learn and navigate its complexities. By understanding the basics, applying sound strategies, and managing risk effectively, you can potentially profit from currency movements in the global market. Remember that while forex trading can be lucrative, it also comes with significant risks—so always trade responsibly and continue learning to enhance your skills.